If you or a loved one uses fraudulent means, such as providing false or incorrect information, to receive welfare benefits from the state, you are considered to have perpetrated welfare fraud. This offense attracts harsh penalties such as fines, restitution, or incarceration, depending on the circumstances. As a result, if you've been charged or accused of welfare fraud, you'll require knowledgeable and competent legal counsel. We at the Michele Ferroni Pasadena Criminal Attorney Law Firm in Pasadena are here to make sure that a conviction is proven rather than assumed, so we are ready to defend you.

Definition of Welfare Fraud Under California Law

Welfare fraud is covered under California Welfare and Institutions Code 10980. According to this law, the defendant commits the crime if he or she gives information knowing it's false to gain access to public services. You could also be convicted of welfare fraud if you deliberately exclude key information to gain access to these benefits. The programs were created by the government to assist people who legitimately need support, and those people must be qualified for these programs. You could be charged with welfare fraud in the following situations:

- When you intentionally provide false information or omit crucial facts to be eligible for welfare benefits, the government assesses you based on the details you provide. You will be convicted of welfare fraud if it's discovered that you fabricated data to obtain, maintain, or enhance the welfare you get from these services

- If you used multiple applications with different names to obtain the benefits multiple times,

- If you're an employee of the welfare system and deliberately and illegally transfer welfare payments to those who do not deserve them

- If you're discovered to have obtained, sold, transferred, bought, altered, counterfeited, or owned necessary approvals to have food stamps, or if you have food stamps and do this

If you or a loved one is charged with welfare fraud for any of the reasons listed above, the prosecutor must prove his or her case beyond a reasonable doubt before you can be convicted.

California's Welfare Programs

California has several welfare programs in place to assist deserving people. Some of these programs include:

1. CalWORKs

This is defined as the California Work Opportunities and Responsibility to Kids program. The welfare program was created to help families who needed economic support for a short period. In this situation, the funds are used to pay for food, medical costs, clothing, housing, and utility bills. If you need immediate assistance, you should visit their offices and submit the required information. The details are then assessed, and if it is determined to be legitimate and worthwhile, you will get assistance from the welfare program.

2. CalFresh

Food stamps are well-known to almost everyone. If you are having trouble affording food, you could apply for help through this service. If you're eligible, you will receive monthly financial assistance in the form of electronic payment to assist you in purchasing food.

3. In-home Services

You, like everyone else, must be eligible to earn perks from this welfare program. If you or a loved one falls into any of the following categories, you could be eligible to apply for aid through this service. These include:

- Domestic violence victims in need of health care, parenting classes, public health information, counseling, and financial assistance

- If you're a substance abuse victim or an addict and require treatment and counseling that you cannot otherwise pay for

- If you are suffering from mental health concerns that require medical attention and counseling. Alternatively, if you are suffering from anxiety or depression, you can seek assistance through the same program

4. Greater Avenues For Independence

Some individuals are unable to secure gainful jobs, requiring them to rely on welfare programs like CalWORKS for temporary support. GAIN collaborates with CalWORKS participants to help people find jobs, hold their jobs, and advance their careers.

5. Assistance or General Relief

If you're an adult living in poverty, you could be eligible for aid through this welfare program. To be eligible for this aid, you should not be receiving assistance from any other program sponsored by the government. If a defendant lies to profit from the general relief program while also benefiting from others, he or she will be deemed to be committing welfare fraud.

6. Medi-Cal

Affording decent health insurance is out of reach for many people. As a result of this reality, the government has developed the Medi-Cal program to help anyone in dire need of medical assistance. Fraud is also perpetrated under this scheme, although it's charged under a different law.

You will be convicted of welfare fraud if you omit or misrepresent necessary details that entitle you to any of the welfare programs. Similarly, if you serve in any welfare scheme and aid someone who doesn't qualify for these services, you will equally be culpable of the offense.

Investigating Welfare Fraud

Before a defendant is convicted of welfare fraud, accusations must be filed and investigations conducted. California welfare fraud is a serious crime, and specific departments have been established to exclusively pursue these cases. These departments' prosecutors receive recommendations for various situations from:

- People who contact their offices or use their websites to report potential fraud incidents

- Agencies devoted to providing social services and welfare benefits

- Interested government bodies suspect possible fraudulent acts

- Tips received through hotlines that are disclosed by the general public

When complaints are made, detectives locate and question the accused. During the investigation, beneficiaries are interrogated about the benefits they received and the details they shared that qualified them for the scheme. You would be required to conform to this form of an interview if you're accused of illegally benefiting from government welfare. Likewise, your friends, relatives, and neighbors would be questioned to see if the details you provided were genuine.

Unfortunately for you, further offenses could be revealed as the investigation continues. Child neglect, drug-related offenses, elderly abuse, and domestic abuse are some of the most common violations. As a result, various government authorities, like agencies responsible for protecting the elderly or child welfare services, get involved in these investigations.

After obtaining and collecting all of the necessary facts, the assistant DA is given a full report to review. Following an assessment of the facts, the prosecutor evaluates whether the proof presented is adequate to pursue criminal charges. If the facts are solid enough, a lawsuit is filed to accuse you of violating WIC 10980. However, there are situations whereby the evidence acquired is inadequate to prosecute the defendant. In this situation, the investigators could be requested to conduct additional inquiries, or the case could be dismissed entirely.

Types of Welfare Fraud

Welfare fraud cases are classified as either internal (involving a program employee) or external (involving the beneficiary of the scheme.)

Internal Welfare Fraud

We previously indicated that staff from welfare programs or the government could potentially be charged with welfare fraud. If you work in government and are caught falsely disbursing benefits, you could be convicted of this crime. This is possible if you're charged with seeking to acquire or channel benefits to an ineligible party.

As a staff member, you could be charged with forging information and filing for benefits on behalf of unqualified family members and friends, and splitting the proceeds. The defendant could even be convicted of fabricating fictitious minors and falsifying income reports that exclude family and/or friends from the scheme. This could also be undertaken to enable their family or friends to obtain more benefits.

If the defendant is a staff member of the welfare program and he or she is facing allegations of internal welfare fraud, they would also face embezzlement charges. If the defendant embezzles a considerable amount of money from the scheme as a government employee, he or she will be punished with felony charges. In this situation, the punishments would include incarceration in state prison.

Recipient Fraud

According to WI 10980, this is a kind of welfare fraud committed by the benefit receiver. You can be convicted of this crime if you attempt to or accept proceeds from a welfare scheme when you are not entitled to them. This offense can be committed in a variety of ways, with some being more common than others. The most common methods include:

- If a defendant obtains these benefits by lying about the fact that he or she is solely responsible for raising his or her children while the defendant's other parent or spouse lives with him or her.

- If the defendant obtains welfare payments from another jurisdiction and still applies for welfare in California

- It's not true if the accused lies about living with a child to get welfare payments or is alleged to have more kids in his or her household

- If the accused is a recipient of several kinds of assistance and does not record it, or if he or she has another source of income

When you're accused of recipient fraud, it implies that you're trying to receive more than you're entitled to using illegal means like deception.

Defenses to Welfare Fraud Charges

When you're facing charges of committing welfare fraud, the prosecutor has the burden of proving that you are guilty of the allegations. The state investigates the claims before pressing criminal allegations against a defendant. Once the defendant is accused of internal or recipient fraud, he or she has a constitutional right to fight back against the allegations. With the assistance of an experienced criminal attorney, you could fight the allegations and have them dismissed or receive a less severe penalty.

Your lawyer will start by questioning you to hear your version of events before going over the prosecutor's evidence against you. In addition, the attorney would conduct an impartial investigation into the claims and plan the best strategies for your case. The following are some popular legal defenses to these allegations:

Inadequate Proof

When a lawsuit is brought to court, the prosecution must demonstrate substantial proof against the defendant to prove their guilt. The prosecution can make claims based on circumstantial evidence, which could lead to your being wrongfully convicted if you don't contest it. For example, if the defendant's boss notices any of the following, he or she could accuse the defendant of perpetrating internal fraud. These include:

- Having duplicates of certain files

- Certain documents are missing from your files

- Being suspicious of how you interact with certain beneficiaries or applicants

While these could give the impression that you're concealing something, they're not enough to convict the defendant. To guarantee that the facts are conclusive, the detectives should investigate the allegations. The prosecution is required by the court to present actual evidence that you committed the alleged crime.

Your lawyer, on the other hand, could argue that you had duplicate files as a precaution or for safety reasons, or that some of the files were lacking because you had not finished working on them. A skilled attorney can raise doubts in the jury's minds and have the defendant cleared for the crime by presenting supporting proof.

Your Actions Were Not Intended To Be Fraudulent

When allegations of welfare fraud are levied against you, one of the most important elements to demonstrate is that you had an intention of defrauding the other party. You can't be convicted if what you perpetrated was not deliberate or intended to steal from the scheme. Your lawyer will contest the charge of fraudulent intent by arguing:

- Based on your understanding, the submissions you made were valid. This method can be used to handle both recipient and internal fraud allegations. There is a likelihood that the defendant did not intend to leave stuff out or submit erroneous information

- If you've been accused of failing to declare additional earnings, there is a possibility that it was not done on purpose. Your lawyer could argue that the extra earnings were the result of gifts, lottery winnings, or inherited wealth that you were unaware had to be disclosed

- You should notify the welfare office when a minor fails to qualify to receive his or her benefits. However, if you truly forgot to update the welfare officials, your lawyer can submit this case on your behalf

For these justifications to work in the defendant's favor, the attorney needs to be compelling and provide evidence to back up his or her arguments. A seasoned defense lawyer knows how and when to use facts to persuade the court of the defendant's innocence. If it's determined that you did not have fraudulent intent, the allegations against you would be withdrawn or you could face a more moderate punishment.

Mistaken Identity or False Accusations

There are numerous reasons why you could be misidentified for an offense or face false accusations. This defense strategy is effective against both beneficiary and internal fraud. As a welfare program employee, you could be charged with fraud even though you have never done it and the program has legitimate allegations of embezzlement. In rare situations, you could be associated with certain applicants and have faith in them. Without your knowledge, they could manipulate and use you to benefit themselves.

If such applicants present forged information or documents, you could not realize they are lying, and more likely, you wouldn't be able to verify the details. You will be guilty of being negligent but not of program fraud or embezzlement in this situation. This type of error can get you fired, but it shouldn't get you a conviction in court.

You could be convicted of fraud if you get welfare benefits and face allegations of listing a child who does not exist. However, it's possible that you had someone send the application on your behalf and that they changed the details you provided. An individual could do this if he or she has a grudge against you and wishes to get you into trouble.

In other cases, a defendant's identity could be stolen by an impostor who would use the credentials to apply for welfare fraudulently. A defense attorney can persuade the court that the accused was not the one who defrauded the welfare system by providing proof of his or her stolen identity. It's also possible that you'll be charged with fraud due to a clerical error when submitting your documentation. Your lawyer can challenge the allegations irrespective of the claims that were presented against you.

Restitution Agreement

In fraud cases, the prosecution has the objective of recovering the stolen funds on behalf of the welfare entity. You can request that the funds be returned in exchange for a decrease in your penalties. When charged with a minor offense, the consequences you face are much less severe. For instance, if the defendant defrauded the program of $30,000, he or she could propose to refund $25,000 to the scheme. This could result in the prosecution reducing the accused's felony charges to misdemeanors and avoiding a jail sentence.

Related Offenses Under WIC 10980

This law outlines the numerous methods by which you could be convicted of welfare fraud. If the defendant makes false or deceptive assertions to get access to a program, he or she will face misdemeanor charges. Once the accused is convicted, he or she would face a six-month jail sentence and hefty cash fines of no more than $500. The law also defines the following welfare fraud offenses:

Filing a Fraudulent Application

Submitting a false application could be convicted as either a felony or misdemeanor if any of the following conditions are met:

- The defendant is discovered to have submitted multiple applications for the same individual

- The defendant submitted a fraudulent request or application for additional benefits on behalf of a non-existing person

- The accused applied for benefits using someone else's details

A felony conviction can result in a 16-month, twenty-four-month, or thirty-six-month prison sentence. You'll also be required to pay cash fines of $5,000 in addition to your jail term.

Misdemeanor charges, on the other hand, can be filed based on the defendant's criminal history and the nature of the offense. A misdemeanor conviction entails a year or less in county jail and cash fines of no more than $1,000.

Food Stamp Fraud

A food stamp is a type of welfare benefit that can be used to perpetrate fraud. You could be convicted of a felony charge if you took part in acts with blank authorization for food stamps. If you're convicted, you would spend between 16 and 36 months in prison. A $5,000 fine is also imposed in addition to the jail term.

When a defendant illegally uses, sells, transfers, possesses or buys food stamps, this crime is considered a wobbler. If the accused illegally changed the food stamps electronically to favor another individual, he or she would be charged as well. The offense is a misdemeanor when the amount of the food stamps is less than $950. A conviction would lead to jail time of 6 months or less and cash fines of no more than $500.

When the cost of food stamps surpasses $950, you will be convicted of felony charges. This conviction carries a sentence of no less than 16 months and no more than 3 years in jail. At the same time, the court will impose a fine of no more than $5,000.

Electronic Benefit Transfer

If the defendant transfers the benefits electronically, he or she could be convicted of fraud, as per California's WIC 10980. This also assists in increasing the accused's penalty if he or she is accused of fraud. The penalties you received would be served in the same order as your original conviction. Among these enhancements are:

- If your transferred benefits totaled more than $50,000, you would be sentenced to an additional year in prison

- You would earn 2 years for your conviction if you transferred perks worth $150,000 or more

- Transferring more than a million dollars results in 3 more years in prison, and

- Any amount above 2.5 million dollars will result in four more years of imprisonment

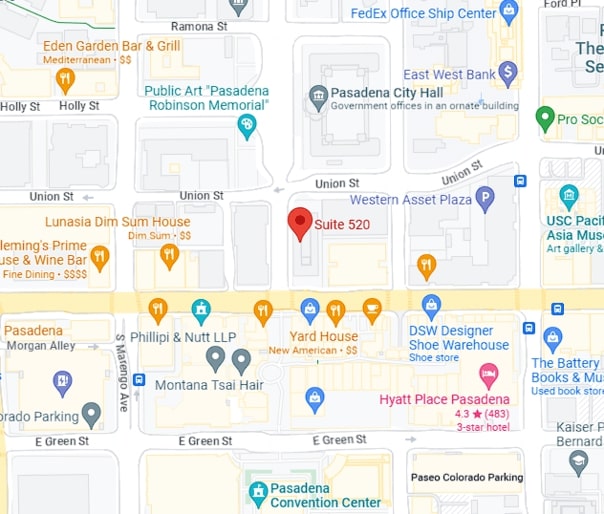

Find a Criminal Defense Lawyer Near Me

California welfare fraud is a serious crime with serious repercussions if convicted. When charged with this crime, you have the right to fight the allegations brought against you with the help of an experienced attorney. At Michele Ferroni Pasadena Criminal Attorney Law Firm, we can assist you in fighting these allegations and possibly avoid serious consequences. Call us at 626-628-0564 if you are in the Pasadena area.